After tax profit margin formula

To find the net profit margin take the after-tax net. 600000 - 400000 - 150000 - 8000 - 6000 36000 divided by.

Net Profit Business Tutor2u

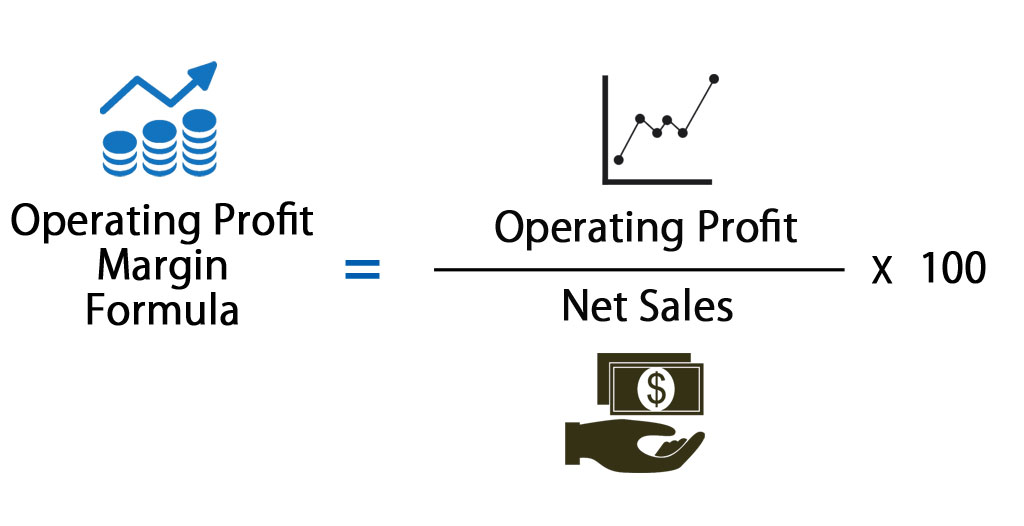

Using the operating margin formula we get Operating Profit Margin formula Operating Profit Net Sales 100 Or Operating Margin 170000 510000 100 13 100.

. An after-tax profit margin is a financial performance metric. Earnings Before Taxes EBT Net Income Taxes EBT can sometimes be found on the income statement Sales Sales revenues recorded in the accounting period A. The pretax profit margin is calculated by the formula.

Pretax Profi t Sales All expenses except Taxes After reducing all the. Rates subject to change. Margin rates as low as 283.

Net Profit INR 30. The definition of an after-tax profit margin is the percentage of. Margin rates as low as 283.

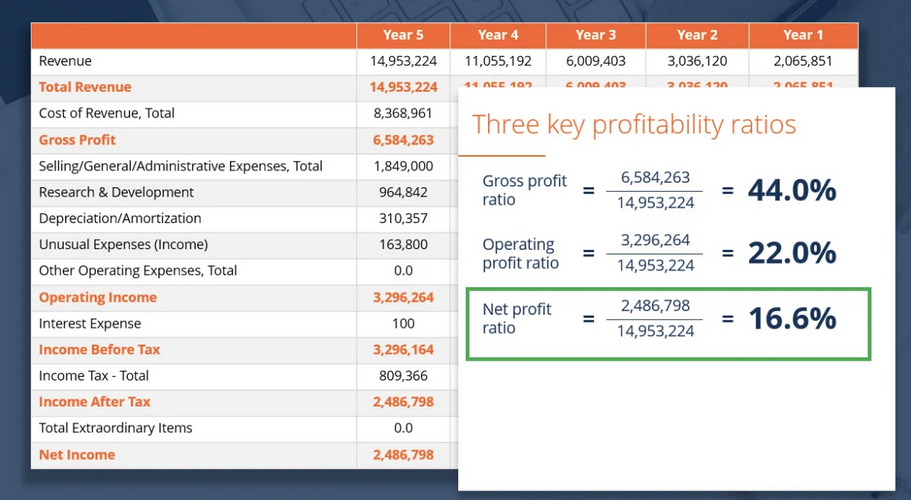

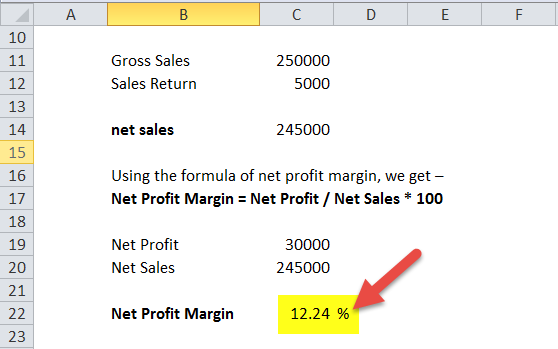

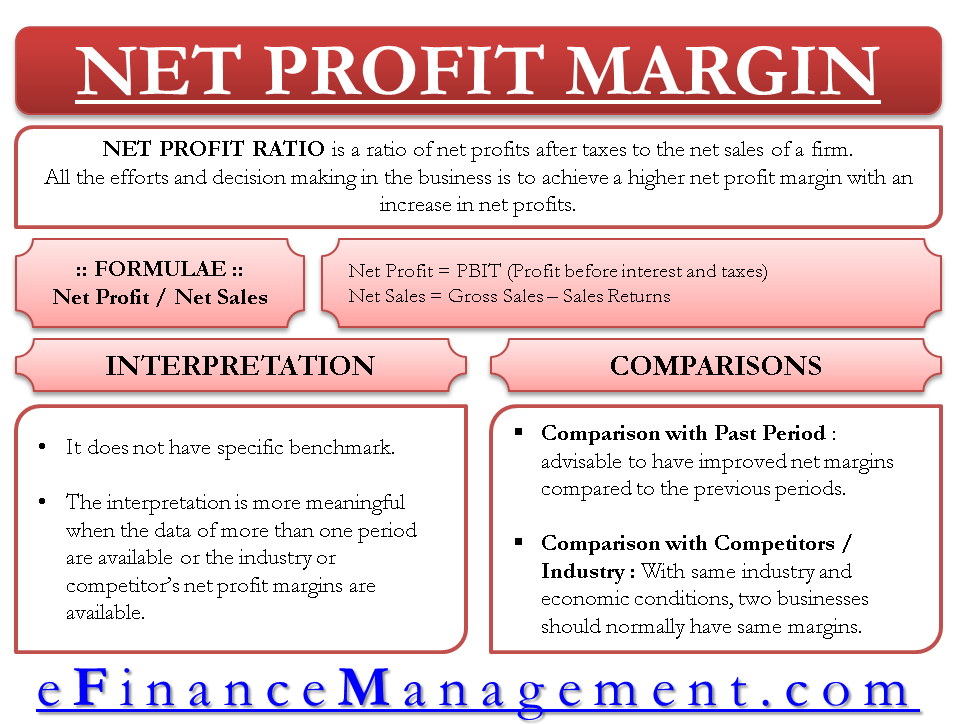

A companys net profit margin tells you how much after-tax profit the business keeps for every dollar it makes in sales. Typically expressed as a percentage net profit margins show how much of each. Net Profit Margin Net Profit Revenue Where Net Profit Revenue - Cost Profit percentage is similar to markup percentage when you calculate gross margin.

EBT 50 million. Net profit margin is the ratio of net profits to revenues for a company or business segment. Net Profit INR 30.

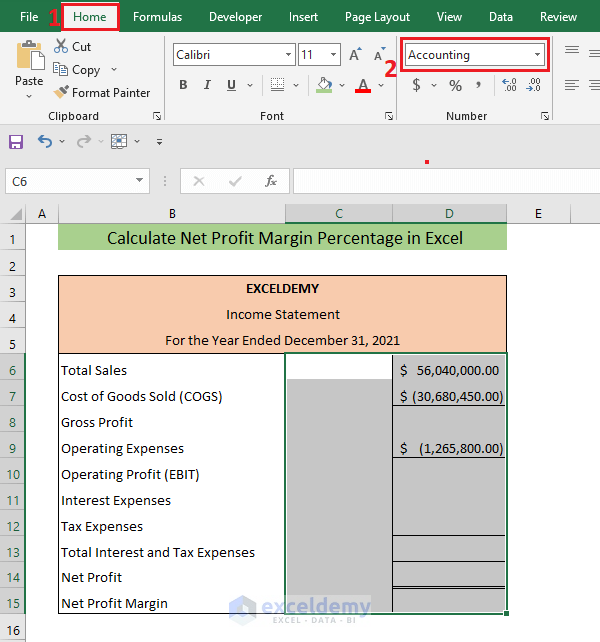

Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. Calculation of net profit. The formula for after-tax profit margin is.

Calculation of net profit. Income Before Taxes divided by Revenue multiplied by 100. The two inputs we need to calculate the pre-tax margin are the earnings before taxes EBT and the revenue for 2021.

Net Income 40 million. Starts at 49 state fees and only takes 5-10 minutes. Total Revenue Total ExpensesTotal Revenue Net ProfitTotal Revenue After-Tax Profit Margin By dividing net profit by total.

Its operating and non-operating expenses are 15000 and. Corporate income tax expense 6000 The retailers profit margin ratio after tax for its most recent year was 6. The formula for after-tax profit margin is.

To calculate Pretax Profit margin we need Pretax Profit Net Sales Let us find both the values and calculate the ratio. Similarly analysts may utilize net profit after Tax to perform additional cash flow estimates. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

Total Revenue INR 500. In other words you take the gross revenue subtract all expenses down to. Over a decade of business.

Rates subject to change. On the basis of the above financial figures we can calculate the net profit margin for FY2018 by using the formula. This may aid in determining the organizations development and cash flow potential.

Net Profit Margin Calculator Bdc Ca

Guide To Profit Margin How To Calculate Profit Margins With Examples

Net Profit Ratio Double Entry Bookkeeping

Operating Profit Margin Formula Calculator Excel Template

Net Profit Margin Prepnuggets

After Tax Profit Margin Definition And Meaning Market Business News

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Profit Percentage Formula Examples With Excel Template

Net Profit Margin Definition Formula How To Calculate

Profit Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Definition Formula How To Calculate

Net Profit Margin Ratio Define Formula Calculate Interpret Compare

Profit Margin Formula Calculator Examples With Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Operating Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Formula And Ratio Calculator Excel Template